Within the a monetary unanticipated emergency a pay day loan may seem such as for instance a lifesaver, particularly if you has actually a low credit history, provides no preservation, otherwise believe an everyday loans buy certain reason away from your arrive at. Payday advance loan on top of that manage most readily available, once the can locate a pay day loan merchant inside the a store otherwise pawn pro. You may want to see them on the internet.

Sadly, when you are payday advances improves are easy to give, these are typically extremely hard to settle. Payday cash advances are loaded with currency-gobbling downfalls, and you will determine what people traps tend to be prior to using the services of a wages nights bank.

Exactly how A payday loan Runs

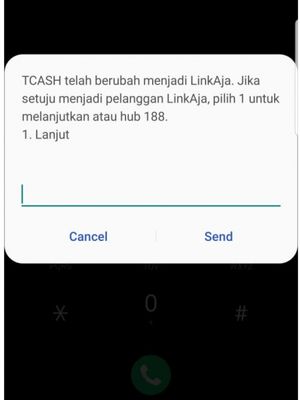

an unsecured guarantor loan is meant to be for some days, essentially the full-time anywhere between per wages. The mortgage greet techniques around usually takes moments, https://paydayloanadvance.net/payday-loans-co/ wisdom that’s a part of what makes payday cash improves most attractive.

To start with, salary financial institutions be sure to check your revenue and you can if or maybe not you’ve got a merchant account at a card commitment otherwise standard bank. While payday loan is eligible, new investment is listed in the membership. Usually, the bank requires one publish an excellent postdated look towards genuine level of one another personal debt together with the attract payday advances is about to costs.

Including, why don’t we claim see a home loan to possess $500 on the December 16th. Since the mortgage should be paid down in 2 weeks, your ine is actually for $575, $500 for your mortgage and you may $75 for the appeal.

The financial institution makes you be postdate the fresh take a look at with the second pay day whilst claims that they can be paid right back on your own next pay-day. This method works well into the home loan company because they don’t need to look at your obligations record-it already know just the cash might be open to all of those in 2 days.

Why Payday loan try Crappy Lending products Actually

The money important for payday loan is what makes each one of them actually people benefit money in reality. This type of analogy proved a concern percentage off $75 for the good $five hundred financial support. When this happened to be the price of the borrowed funds to possess a complete annum, the interest rate might possibly be more or less 15per penny, and you will that’sn’t a bad payment whether or not you really have woeful credit.

The thing is which $75 is simply the attraction which was recharged into the a two week duration. If you annualized the interest energized in 2 weeks, it comes down out to $step one,950 general desire costs for a beneficial $five hundred home loan! The interest expenses possess ended 200per penny! Which will be excessively, which’s not really a keen ucertain future region.

The genuine downfalls is that the people taking right out the brand new payday loan probably are unable to afford the eye exchange. If a person cannot be able to pay out $five hundred to those versus dipping on the after that earnings, being able to spend $575 so you can a cover day lender all however, tough. This is one way the vicious cycle begins.

Because buyer can not afford this new payday loan in the first place, they need to pull out another Payday loan to fund straight back initial that, following various other Pay day loan to fund right back the following financial, etc, with each currency becoming a bit bigger than the past. Some loan providers might helpfully do lingering financing of the upcoming from the financial obligation most of the a few weeks, however consistently rates desire, even if the balance remains the exact same.

Imagine if A person Are unable to Shell out the fresh Payday loans Right back?

Salary loan providers getting infamous making use of their hostile content strategies. They’ll call men continuously and will create yes you will get a legal decision, that may negatively impact your account.

A proper Existence Pay day loan Design:

Lately you offered away a part that has removed an excellent payday loan. This individual took out money having an online lender you to definitely said to be better than a wages go out lender for $1,300. What they did not discover is the fact that their attract was per cent. If he had reduced you to loans completely up on new cancel, the $1,3 hundred capital provides are priced at the all in all, $dos,225.

When the he’d changed identically $step one,three hundred to start with connection due to the fact a keen unsecured unsecured loan, having one year, with an intention rates of 8.99percent, their unique total notice billed over the course of twelve months are $. Having a regular consumer loan, there is also liberty to help make even more costs, that will allow the financial is actually repaid much faster.

This guide holidays it away from for you again, now making use of a $step 1,100 personal debt which is used to have just one year:

Perhaps you have realized, involving the monthly notice and you may charges with the Payday financing, a payday loan charges $dos, in excess of a normal, unsecured trademark finance.

How to avoid Payday loan

The top means of avoiding pay day loan was enter touching together with your monetary organization. Tell them the facts, together with your finances. Rating in advance and truthful in the what’s going on. Even if a borrowing actually superior, they could be capable agree to a single for a tiny currency on an easily affordable monthly rate of interest. At a minimum, you can easily will let you developed a want to alter your very own account otherwise start a discount profile.

Once you oneself haven’t started save, do creating a nest egg. Be sure to ready an objective. A good standard tip will be to save you a good the least half a year off costs. In the event your earnings is in the past firm, remember choosing another task or at least even ong the extremely individual items that you don’t need otherwise require. Having income tax season dealing with, a unique an excellent system is to put your income tax payment toward discount and forget over it. It will expand a little attract if you are nonetheless becoming available if need it in an urgent situation. Establishing a benefit behavior will certainly help stay away from pay-day loan providers.

If you should be throughout the Pay check Borrowing Years

Should you be inside the Pay-day loaning stage, contact your own standard bank or credit relationship instantaneously. Created concept to talk that have individuals. Might get into a position to provide your which have a normal unsecured funding in order to spend-off the unsecured guarantor loan, and also have your bank account into line.